Fsa Income Limits 2025 - Irs 2025 Fsa Limits, But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). The fsa contribution limits increased from 2023 to 2025. Fsa 2023 Contribution Limits 2023 Calendar, For 2025, the lowest rate of 10% will apply to individuals with taxable income up to $11,600 and joint filers up to $23,200. See what types of aid you you may qualify for.

Irs 2025 Fsa Limits, But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). The fsa contribution limits increased from 2023 to 2025.

Irs 2025 Fsa Limits, Health fsa limits (irc §125(i)) maximum salary reduction contribution: But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

dependent care fsa limit Reactive Cyberzine Image Library, If you don’t use all the funds in your account, you may. Like the 401(k) limit increase, this one is lower than the previous year’s increase.

Health FSA Contribution Max Jumps 200 in 2023 MedBen, See what types of aid you you may qualify for. For 2025, the lowest rate of 10% will apply to individuals with taxable income up to $11,600 and joint filers up to $23,200.

But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

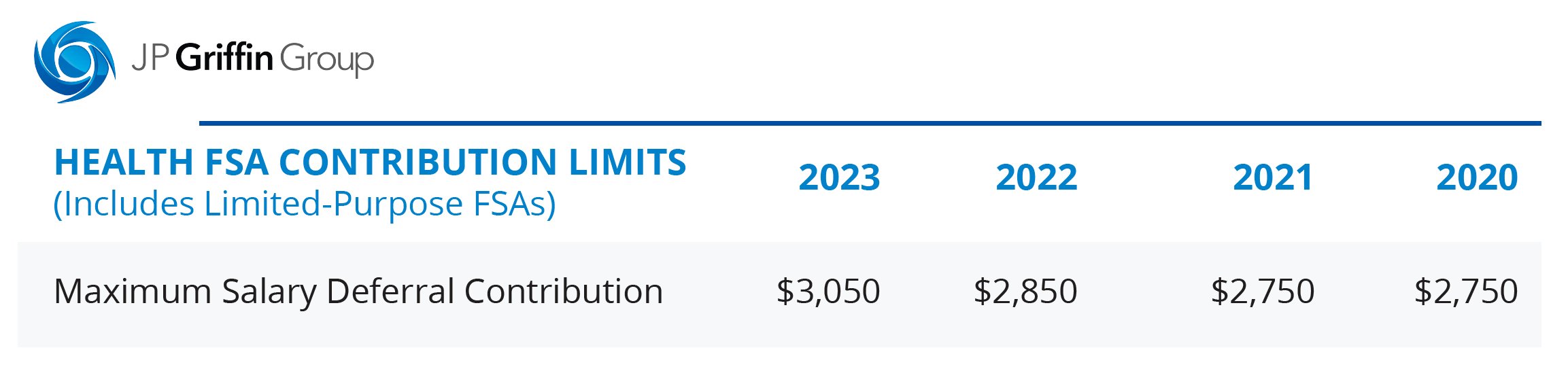

Fsa Income Limits 2025. For 2025, the lowest rate of 10% will apply to individuals with taxable income up to $11,600 and joint filers up to $23,200. The annual contribution limit for fsas has been raised to $3,200, compared to $3,050 in 2023.

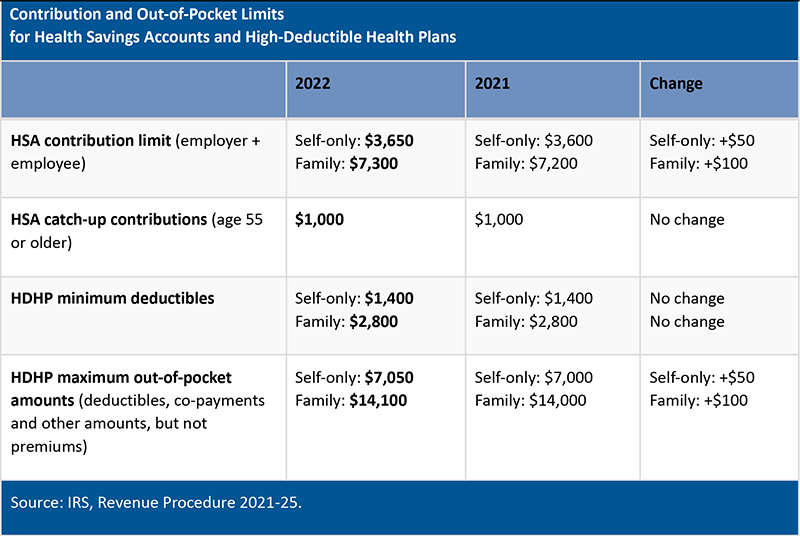

The irs has recently disclosed adjustments to contribution limits for 2025, bringing some changes to both fsas and hsas.

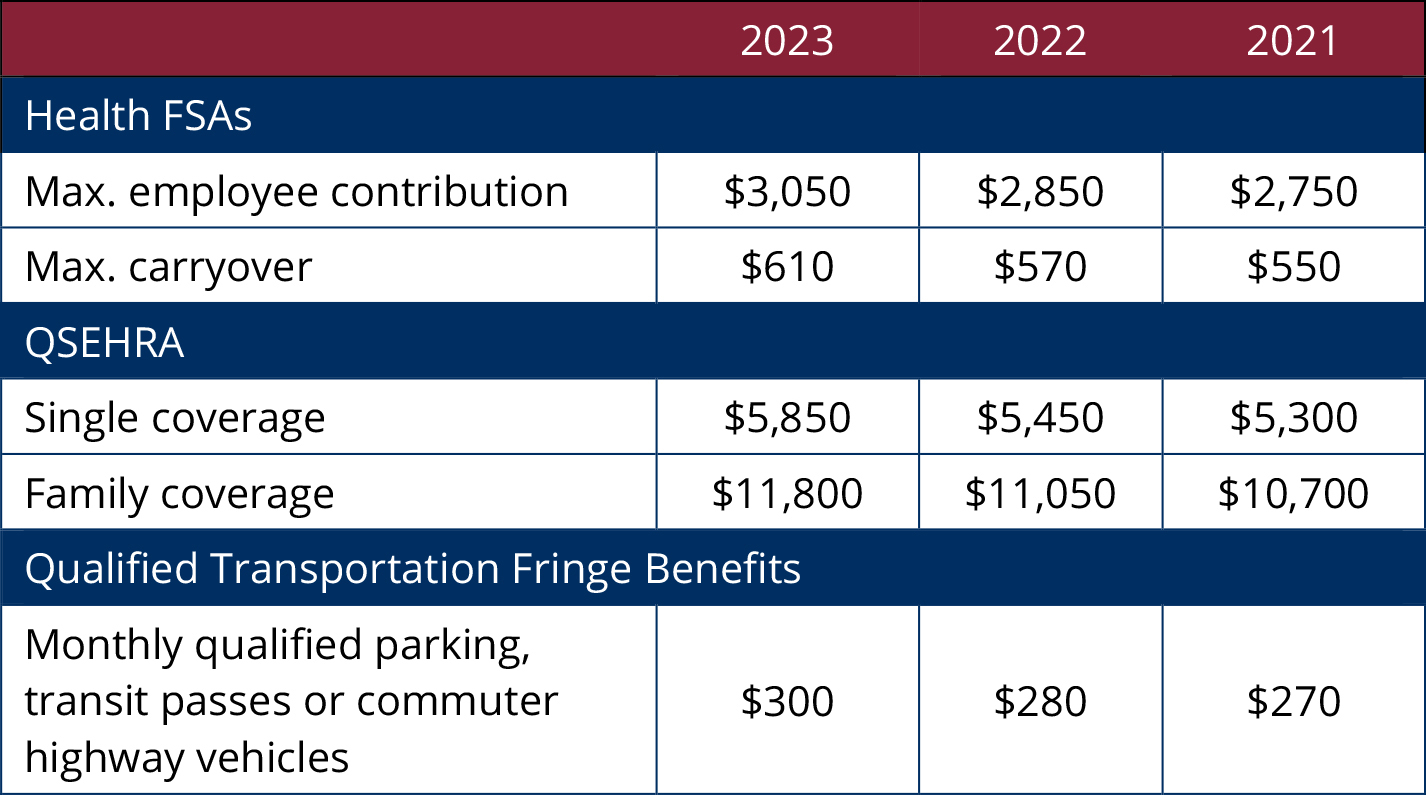

2023 FSA limits, commuter limits, and more are now available WEX Inc., Carryovers allow you to spend a maximum of $610 of unused healthcare. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Increases to $3,200 in 2025 (up $150 from $3,050 in 2023) fsa carryover limit:

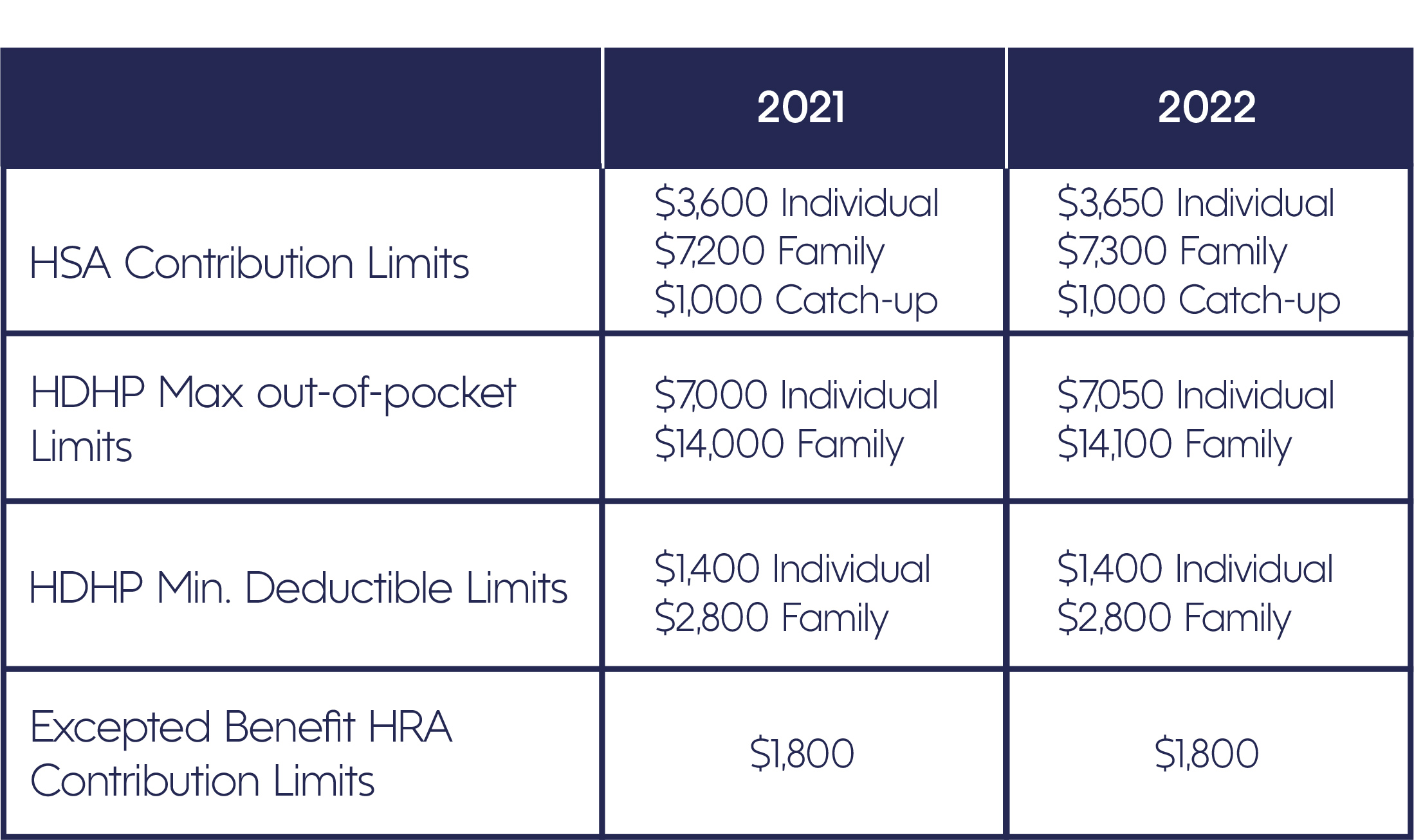

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, New fsa and hsa limits. While there are no income limits for the fafsa, your family's income does affect your financial aid eligibility.